Loan Repayment Prediction

A LightGBM Model to identify borrowers who are most likely to repay a loan,thus resulting in a profitable bank.

Business Problem

The two most critical questions in the lending industry are: 1) How risky is the borrower? 2) Given the borrower’s risk, should we lend him/her? The answer to the first question determines the interest rate the borrower would have. Interest rate measures among other things (such as time value of money) the riskness of the borrower, i.e. the riskier the borrower, the higher the interest rate.

Investors (lenders) provide loans to borrowers in exchange for the promise of repayment with interest. That means the lender only makes profit (interest) if the borrower pays off the loan. However, if he/she doesn’t repay the loan, then the lender loses money.

Our Goal is to understand the loan business of the bank.It wants to identify who would be the right target for the loans. The data contains both customers who have been given loans and those who haven’t yet received loans. The aim is to identify of the customers who haven’t been granted a loan which are more likely to repay the loan and provide loans to them.

Data Set

- Borrower_table - informtion about the borrowers such as age, salary, checking/savings amount and previous credit history.

- Loan_table – loan details such as repayment history, loan purpose.

Roadmap

- Dataset missing value, outlier analysis

- Data Transformation

- Data Exploration for Insights

- Data Preparation for Model Building

- Model Build to maximize profit

- Model Selection

- Recommendations based on target audience

import numpy as np

import pandas as pd

from sklearn.metrics import auc, roc_curve,roc_auc_score, classification_report,accuracy_score

from sklearn.metrics import roc_curve

from sklearn.ensemble import RandomForestClassifier, GradientBoostingClassifier

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import LabelEncoder

import matplotlib.pyplot as plt

import seaborn as sns

plt.style.use('ggplot')

%matplotlib inline

import lightgbm as lgb

Data Loading

Loan Table:

- Dataset contains 101100 unique loans and has 5 features including loan granted and loan repaid.

- Loan Repaid has 3 values: 0,1,NaN

- Definition of Loan Repaid:

Loan Granted and Repaid then repaid is 1

Loan Granted and Not Repaid then repaid is 0

Loan Not Granted then Repaid is NaN

loan = pd.read_csv('loan_table.csv',parse_dates =[ 'date'])

loan.head()

| loan_id | loan_purpose | date | loan_granted | loan_repaid | |

|---|---|---|---|---|---|

| 0 | 19454 | investment | 2012-03-15 | 0 | NaN |

| 1 | 496811 | investment | 2012-01-17 | 0 | NaN |

| 2 | 929493 | other | 2012-02-09 | 0 | NaN |

| 3 | 580653 | other | 2012-06-27 | 1 | 1.0 |

| 4 | 172419 | business | 2012-05-21 | 1 | 0.0 |

loan.shape

(101100, 5)

len(loan.loan_id.unique())

101100

loan.isnull().sum()

loan_id 0

loan_purpose 0

date 0

loan_granted 0

loan_repaid 53446

dtype: int64

loan[(loan.loan_granted == 1) & (loan.loan_repaid.isnull())]

| loan_id | loan_purpose | date | loan_granted | loan_repaid |

|---|

Borrower Table:

Dataset has loan id which is foreign key to loans table.

It has 101100 obs with 12 features related to the borrower.

A few columns have missing values. Currently Repaying other loans will be Nan if the borrower has never applied for a loan before.

borrower = pd.read_csv('borrower_table.csv')

borrower.head()

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 289774 | 1 | NaN | NaN | 8000 | 0.49 | 3285 | 1073 | 0 | 0 | 47 | 3 |

| 1 | 482590 | 0 | 1.0 | 0.0 | 4500 | 1.03 | 636 | 5299 | 1 | 13500 | 33 | 1 |

| 2 | 135565 | 1 | NaN | NaN | 6900 | 0.82 | 2085 | 3422 | 1 | 24500 | 38 | 8 |

| 3 | 207797 | 0 | 1.0 | 0.0 | 1200 | 0.82 | 358 | 3388 | 0 | 0 | 24 | 1 |

| 4 | 828078 | 0 | 0.0 | 0.0 | 6900 | 0.80 | 2138 | 4282 | 1 | 18100 | 36 | 1 |

borrower.shape

(101100, 12)

len(borrower.loan_id.unique())

101100

borrower.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 101100 entries, 0 to 101099

Data columns (total 12 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 loan_id 101100 non-null int64

1 is_first_loan 101100 non-null int64

2 fully_repaid_previous_loans 46153 non-null float64

3 currently_repaying_other_loans 46153 non-null float64

4 total_credit_card_limit 101100 non-null int64

5 avg_percentage_credit_card_limit_used_last_year 94128 non-null float64

6 saving_amount 101100 non-null int64

7 checking_amount 101100 non-null int64

8 is_employed 101100 non-null int64

9 yearly_salary 101100 non-null int64

10 age 101100 non-null int64

11 dependent_number 101100 non-null int64

dtypes: float64(3), int64(9)

memory usage: 9.3 MB

borrower.isnull().sum()

loan_id 0

is_first_loan 0

fully_repaid_previous_loans 54947

currently_repaying_other_loans 54947

total_credit_card_limit 0

avg_percentage_credit_card_limit_used_last_year 6972

saving_amount 0

checking_amount 0

is_employed 0

yearly_salary 0

age 0

dependent_number 0

dtype: int64

borrower.describe()

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 101100.000000 | 101100.000000 | 46153.000000 | 46153.000000 | 101100.000000 | 94128.000000 | 101100.000000 | 101100.000000 | 101100.000000 | 101100.000000 | 101100.000000 | 101100.000000 |

| mean | 499666.826726 | 0.543492 | 0.899291 | 0.364332 | 4112.743818 | 0.724140 | 1799.617616 | 3177.150821 | 0.658675 | 21020.727992 | 41.491632 | 3.864748 |

| std | 288662.006929 | 0.498107 | 0.300946 | 0.481247 | 2129.121462 | 0.186483 | 1400.545141 | 2044.448155 | 0.474157 | 18937.581415 | 12.825570 | 2.635491 |

| min | 30.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 18.000000 | 0.000000 |

| 25% | 250333.750000 | 0.000000 | 1.000000 | 0.000000 | 2700.000000 | 0.600000 | 834.000000 | 1706.000000 | 0.000000 | 0.000000 | 32.000000 | 2.000000 |

| 50% | 499885.000000 | 1.000000 | 1.000000 | 0.000000 | 4100.000000 | 0.730000 | 1339.000000 | 2673.000000 | 1.000000 | 21500.000000 | 41.000000 | 3.000000 |

| 75% | 749706.250000 | 1.000000 | 1.000000 | 1.000000 | 5500.000000 | 0.860000 | 2409.000000 | 4241.000000 | 1.000000 | 35300.000000 | 50.000000 | 6.000000 |

| max | 999987.000000 | 1.000000 | 1.000000 | 1.000000 | 13500.000000 | 1.090000 | 10641.000000 | 13906.000000 | 1.000000 | 97200.000000 | 79.000000 | 8.000000 |

Data Merging

Combine Loan and Borrower information to get a full dataset which can be used for analysis.

full_data = pd.merge(left = borrower, right = loan, on = 'loan_id',how = 'left')

full_data.head()

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | loan_purpose | date | loan_granted | loan_repaid | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 289774 | 1 | NaN | NaN | 8000 | 0.49 | 3285 | 1073 | 0 | 0 | 47 | 3 | business | 2012-01-31 | 0 | NaN |

| 1 | 482590 | 0 | 1.0 | 0.0 | 4500 | 1.03 | 636 | 5299 | 1 | 13500 | 33 | 1 | investment | 2012-11-02 | 0 | NaN |

| 2 | 135565 | 1 | NaN | NaN | 6900 | 0.82 | 2085 | 3422 | 1 | 24500 | 38 | 8 | other | 2012-07-16 | 1 | 1.0 |

| 3 | 207797 | 0 | 1.0 | 0.0 | 1200 | 0.82 | 358 | 3388 | 0 | 0 | 24 | 1 | investment | 2012-06-05 | 0 | NaN |

| 4 | 828078 | 0 | 0.0 | 0.0 | 6900 | 0.80 | 2138 | 4282 | 1 | 18100 | 36 | 1 | emergency_funds | 2012-11-28 | 0 | NaN |

full_data.shape

(101100, 16)

Total 47,654 loans were granted which is 47% of the total loans and 53% were not granted.

grant = len(full_data[full_data['loan_granted'] == 1])

no_grant = len(full_data[full_data['loan_granted'] == 0])

print('Total Loans Granted: {}'.format(grant))

print('Total Loans Not Granted: {}'.format(no_grant))

Total Loans Granted: 47654

Total Loans Not Granted: 53446

Filter the dataset to include only the loans which were granted. This leaves us with 47654 observations.

data = full_data[full_data['loan_granted'] == 1]

len(data)

47654

data.head()

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | loan_purpose | date | loan_granted | loan_repaid | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | 135565 | 1 | NaN | NaN | 6900 | 0.82 | 2085 | 3422 | 1 | 24500 | 38 | 8 | other | 2012-07-16 | 1 | 1.0 |

| 5 | 423171 | 1 | NaN | NaN | 6100 | 0.53 | 6163 | 5298 | 1 | 29500 | 24 | 1 | other | 2012-11-07 | 1 | 1.0 |

| 7 | 200139 | 1 | NaN | NaN | 4000 | 0.57 | 602 | 2757 | 1 | 31700 | 36 | 8 | business | 2012-09-19 | 1 | 0.0 |

| 8 | 991294 | 0 | 1.0 | 0.0 | 7000 | 0.52 | 2575 | 2917 | 1 | 58900 | 33 | 3 | emergency_funds | 2012-12-04 | 1 | 1.0 |

| 9 | 875332 | 0 | 1.0 | 0.0 | 4300 | 0.83 | 722 | 892 | 1 | 5400 | 32 | 7 | business | 2012-01-20 | 1 | 1.0 |

Data Quality Analysis

- We see that a few columns such as currently repaying previous loans has large number of nulls.

- After closer examination we see currently repaying previous loans and fully repaid previous loans is null for only first loan which makes sense since the borrower is applying for a loan for the first time.

data.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 47654 entries, 2 to 101099

Data columns (total 16 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 loan_id 47654 non-null int64

1 is_first_loan 47654 non-null int64

2 fully_repaid_previous_loans 21865 non-null float64

3 currently_repaying_other_loans 21865 non-null float64

4 total_credit_card_limit 47654 non-null int64

5 avg_percentage_credit_card_limit_used_last_year 46751 non-null float64

6 saving_amount 47654 non-null int64

7 checking_amount 47654 non-null int64

8 is_employed 47654 non-null int64

9 yearly_salary 47654 non-null int64

10 age 47654 non-null int64

11 dependent_number 47654 non-null int64

12 loan_purpose 47654 non-null object

13 date 47654 non-null datetime64[ns]

14 loan_granted 47654 non-null int64

15 loan_repaid 47654 non-null float64

dtypes: datetime64[ns](1), float64(4), int64(10), object(1)

memory usage: 6.2+ MB

data.isnull().sum()

loan_id 0

is_first_loan 0

fully_repaid_previous_loans 25789

currently_repaying_other_loans 25789

total_credit_card_limit 0

avg_percentage_credit_card_limit_used_last_year 903

saving_amount 0

checking_amount 0

is_employed 0

yearly_salary 0

age 0

dependent_number 0

loan_purpose 0

date 0

loan_granted 0

loan_repaid 0

dtype: int64

#Data quality check

data[(data.is_first_loan == 1 ) & (data.fully_repaid_previous_loans == 1.0)]

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | loan_purpose | date | loan_granted | loan_repaid |

|---|

data[(data.is_first_loan == 1 ) & (data.currently_repaying_other_loans == 1.0)]

| loan_id | is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | total_credit_card_limit | avg_percentage_credit_card_limit_used_last_year | saving_amount | checking_amount | is_employed | yearly_salary | age | dependent_number | loan_purpose | date | loan_granted | loan_repaid |

|---|

A simple initial data investigation can tell us how many loans were granted and how many were actually repaid

- Total 47654 Loan were granted

- Out of which 64% of the loans were repaid and 36% were unpaid.

tot_loans = len(data)

tot_loans_rep = len(data[data['loan_repaid'] == 1.0])

tot_loan_norep = len(data[data['loan_repaid'] == 0.0])

print('Total Loans Granted: {}'.format(tot_loans))

print('Total Loans Repaid: {}'.format(tot_loans_rep))

print('Total Loans Not Repaid: {}'.format(tot_loan_norep))

Total Loans Granted: 47654

Total Loans Repaid: 30706

Total Loans Not Repaid: 16948

Data Exploration(EDA)

We will begin by extracting some date features to better understand our data.

# parse date information and extract month, week, and dayofweek information

data['month'] = data['date'].apply(lambda x: x.month)

data['week'] = data['date'].apply(lambda x: x.week)

data['dayofweek'] = data['date'].apply(lambda x: x.dayofweek)

<ipython-input-247-a568e6d2ef8a>:2: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data['month'] = data['date'].apply(lambda x: x.month)

<ipython-input-247-a568e6d2ef8a>:3: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data['week'] = data['date'].apply(lambda x: x.week)

<ipython-input-247-a568e6d2ef8a>:4: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

data['dayofweek'] = data['date'].apply(lambda x: x.dayofweek)

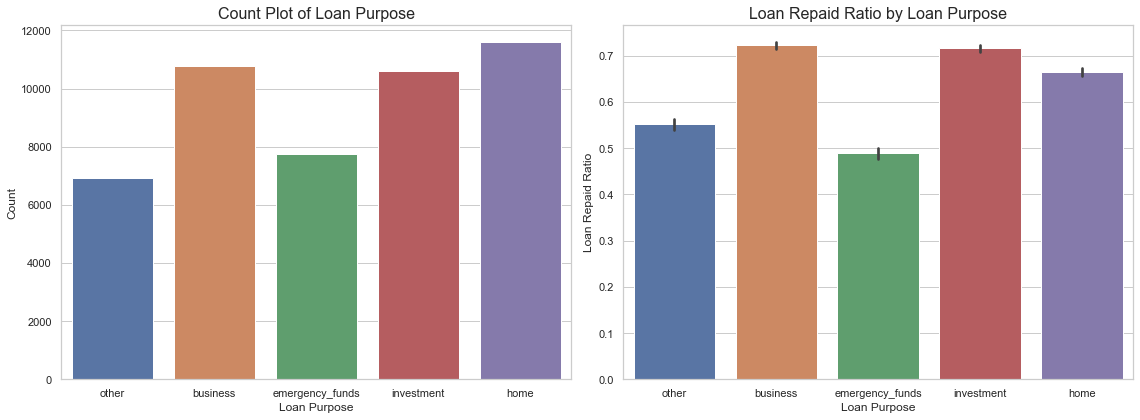

Loan Repayment Rate by Loan Purpose

Results:

- A lot of the borrowers apply for a loan when purchasing a house, or for business and investment purposes.

- Business and Investment have highest re-payment rate whereas Emergency funds have the lowest rate.

#Visualization of loan purpose

sns.set(style="whitegrid", color_codes=True)

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.countplot(x='loan_purpose', data=data, ax=ax[0])

ax[0].set_xlabel('Loan Purpose', fontsize=12)

ax[0].set_ylabel('Count', fontsize=12)

ax[0].set_title('Count Plot of Loan Purpose', fontsize=16)

sns.barplot(x='loan_purpose', y='loan_repaid', data=data, ax=ax[1])

ax[1].set_xlabel('Loan Purpose', fontsize=12)

ax[1].set_ylabel('Loan Repaid Ratio', fontsize=12)

ax[1].set_title('Loan Repaid Ratio by Loan Purpose', fontsize=16)

plt.tight_layout()

plt.show()

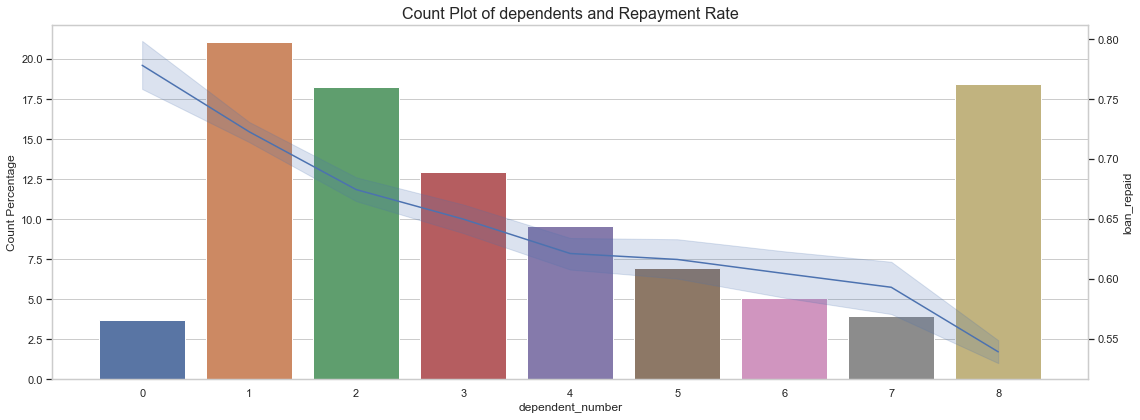

Loan Repayment Rate by Number of dependents

Results:

- My inital assumption was higher the number of dependents, lower the repayment rate. More dependents might lead to more expenses and lesser savings to repay the loan. This assumption was validated by the data.

- Loan Repayment rate is highest when number of dependents is 0 or 1 and it is inversely proportional to number of dependents.

- Just over 2.5% loans are granted to people with zero dependents but more than 17.5% are granted to people with 8 dependents.

#Dependent number

fig, ax = plt.subplots(nrows=1, ncols=1, figsize=(16, 6))

sns.barplot(x="dependent_number", y="dependent_number", data=data, estimator=lambda x: len(x) / len(data) * 100,ax = ax)

ax.set_xlabel('dependent_number', fontsize=12)

ax.set_ylabel('Count Percentage', fontsize=12)

ax.set_title('Count Plot of dependents and Repayment Rate', fontsize=16)

ax2 = ax.twinx()

sns.lineplot(x='dependent_number', y='loan_repaid', data=data, ax=ax2)

ax2.grid(False)

plt.tight_layout()

plt.show()

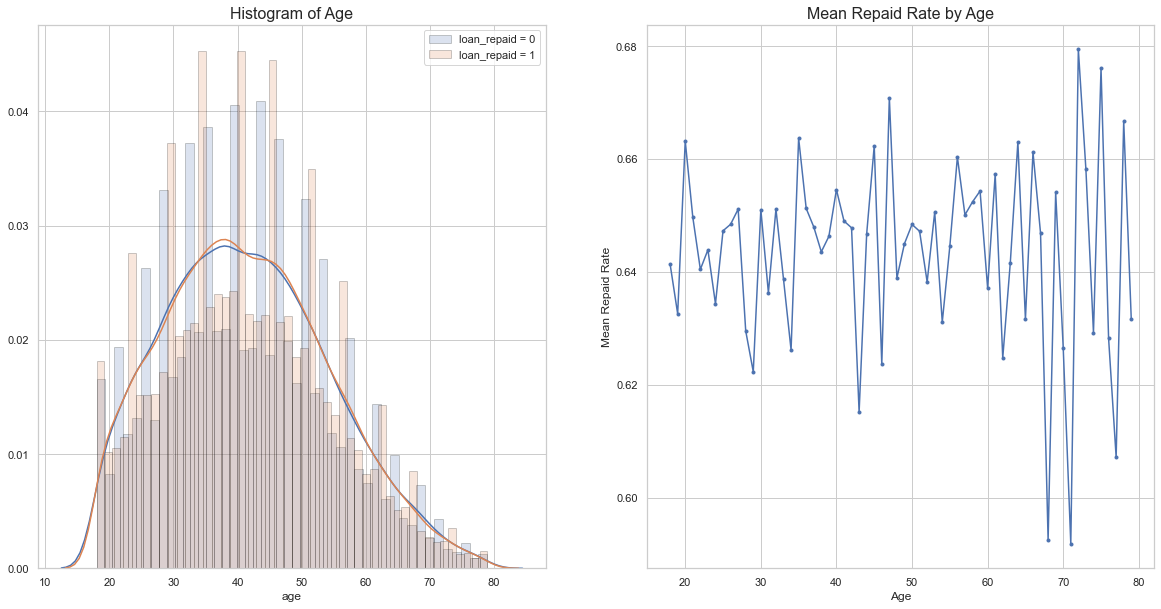

Loan Repayment Rate by Age

Results:

- A lot of the borrowers applying for the loan are between 30-55 years of age.

- Loan Repayment rate fluctuates with age.

#Age

grouped_age = data[['age', 'loan_repaid']].groupby('age')

grouped_age

mean_age = grouped_age.mean().reset_index()

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

sns.distplot(data[data['loan_repaid'] == 0]['age'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['age'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Histogram of Age', fontsize=16)

ax[0].legend()

ax[1].plot(mean_age['age'], mean_age['loan_repaid'], '.-')

ax[1].set_title('Mean Repaid Rate by Age', fontsize=16)

ax[1].set_xlabel('Age')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

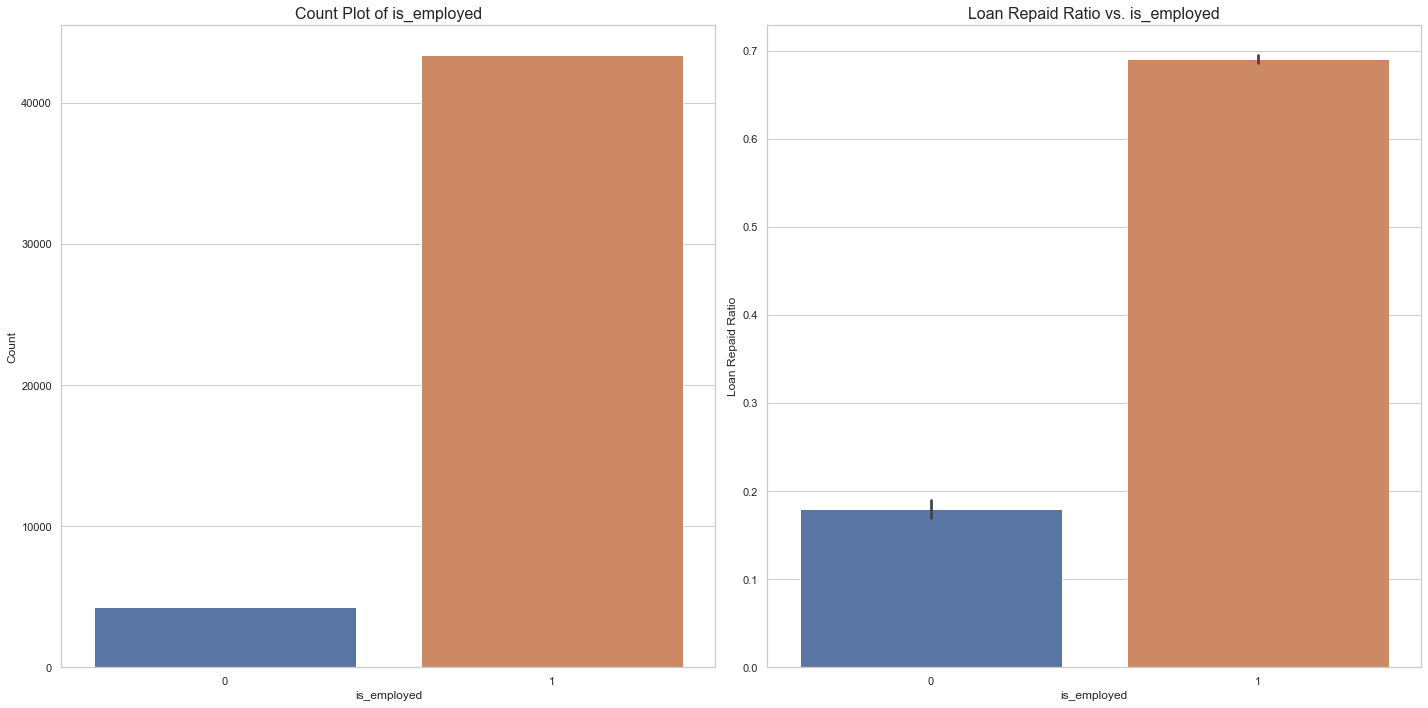

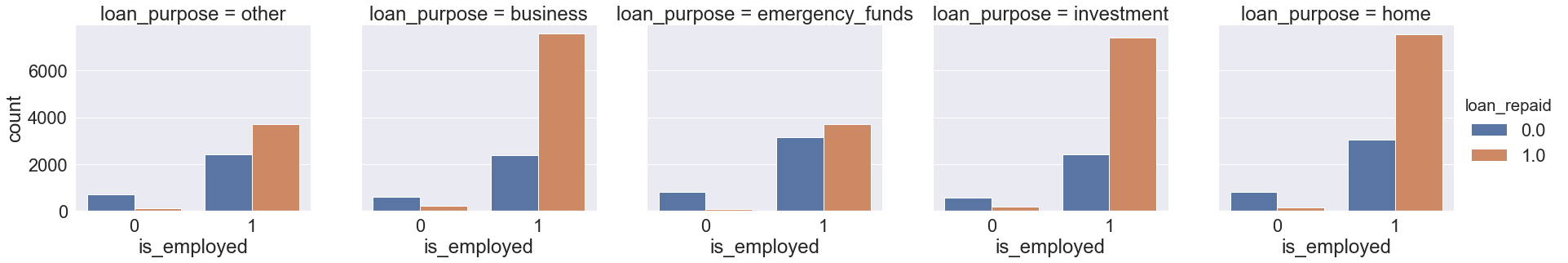

Loan Repayment Rate by Employment status

Results:

- A lot of the borrowers who were granted the loan are employed and are able to repay the loan.

- Repayment Rate among the ones who are unemployed is just 18%.

len(data[(data.is_employed == 0) & (data.loan_repaid == 1)])/len(data[data.is_employed == 0])

0.17942750756341633

#is_employed

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

sns.countplot(x='is_employed', data=data, ax=ax[0])

ax[0].set_xlabel('is_employed', fontsize=12)

ax[0].set_ylabel('Count', fontsize=12)

ax[0].set_title('Count Plot of is_employed', fontsize=16)

sns.barplot(x='is_employed', y='loan_repaid', data=data, ax=ax[1])

ax[1].set_xlabel('is_employed', fontsize=12)

ax[1].set_ylabel('Loan Repaid Ratio', fontsize=12)

ax[1].set_title('Loan Repaid Ratio vs. is_employed', fontsize=16)

plt.tight_layout()

plt.show()

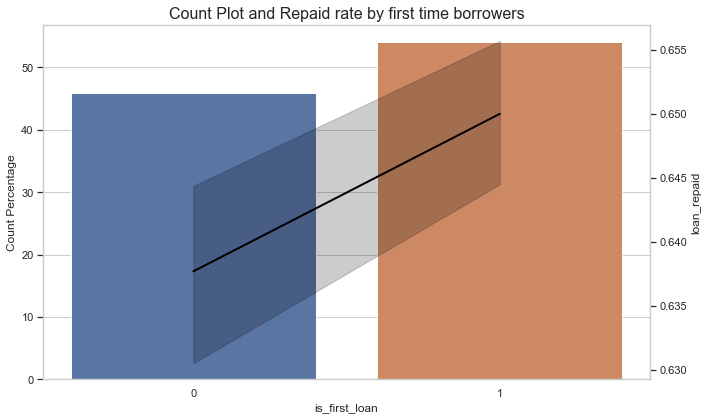

Loan Repayment Rate among first time loans¶

Results:

- A lot of the borrowers who were granted a loan are first time borrowers.

- More than 50% loans are granted to first-time borrowers who have a repayment rate of around 65%.

- Repayment Rate is more than 60% for both first and non-first timers.

#is_first_loan

fig, ax = plt.subplots(nrows=1, ncols=1, figsize=(10, 6))

sns.barplot(x="is_first_loan", y="is_first_loan", data=data, estimator=lambda x: len(x) / len(data) * 100,ax = ax)

ax.set_xlabel('is_first_loan', fontsize=12)

ax.set_ylabel('Count Percentage', fontsize=12)

ax.set_title('Count Plot and Repaid rate by first time borrowers', fontsize=16)

ax2 = ax.twinx()

sns.lineplot(x='is_first_loan', y='loan_repaid', data=data, color = "black",lw = 2,markers=True,ax=ax2)

ax2.grid(False)

plt.tight_layout()

plt.show()

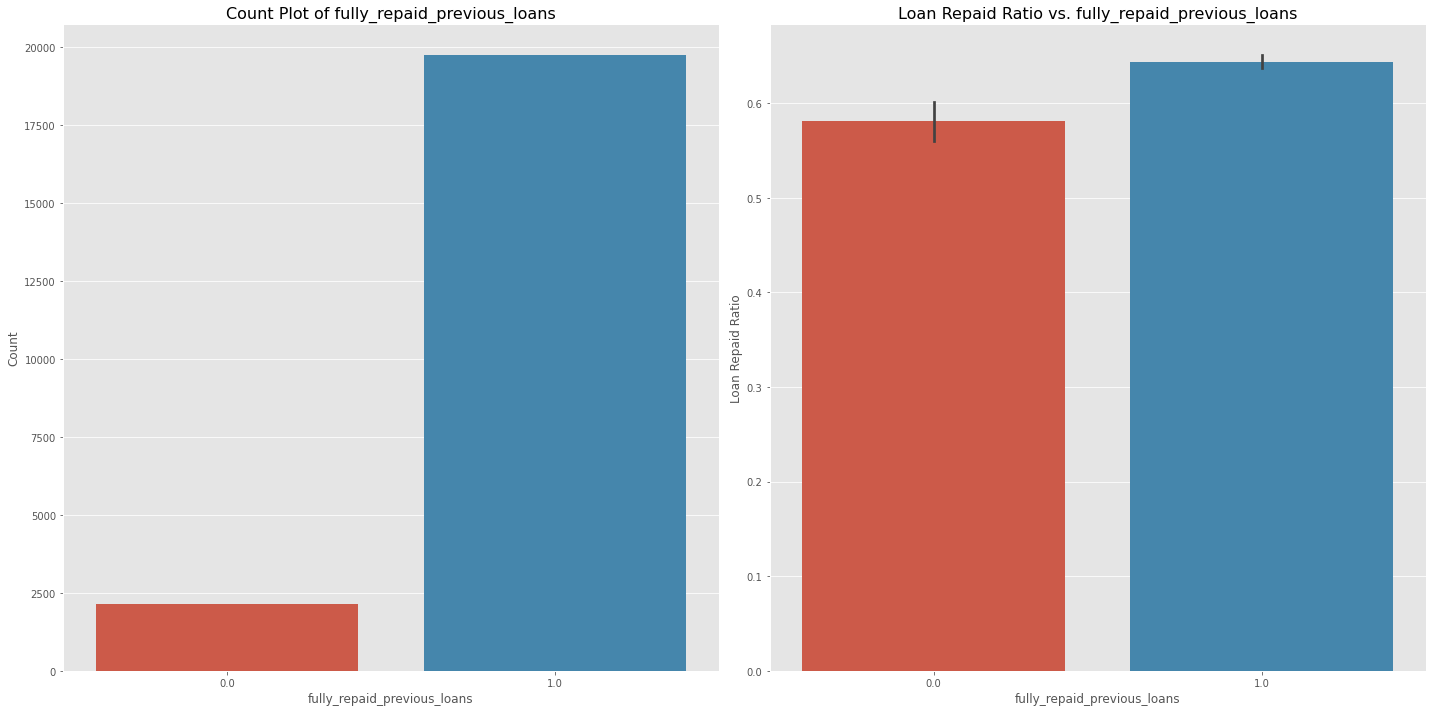

Loan Repayment Rate by Previous Loan History

Results:

- Not a lot of loans were granted to people who defaulted on their previous loans.

- Surprisingly, Repayment rate is above 55% for those who did not pay their previous loans.

#fully_repaid_previous_loans

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

sns.countplot(x='fully_repaid_previous_loans', data=data, ax=ax[0])

ax[0].set_xlabel('fully_repaid_previous_loans', fontsize=12)

ax[0].set_ylabel('Count', fontsize=12)

ax[0].set_title('Count Plot of fully_repaid_previous_loans', fontsize=16)

sns.barplot(x='fully_repaid_previous_loans', y='loan_repaid', data=data, ax=ax[1])

ax[1].set_xlabel('fully_repaid_previous_loans', fontsize=12)

ax[1].set_ylabel('Loan Repaid Ratio', fontsize=12)

ax[1].set_title('Loan Repaid Ratio vs. fully_repaid_previous_loans', fontsize=16)

plt.tight_layout()

plt.show()

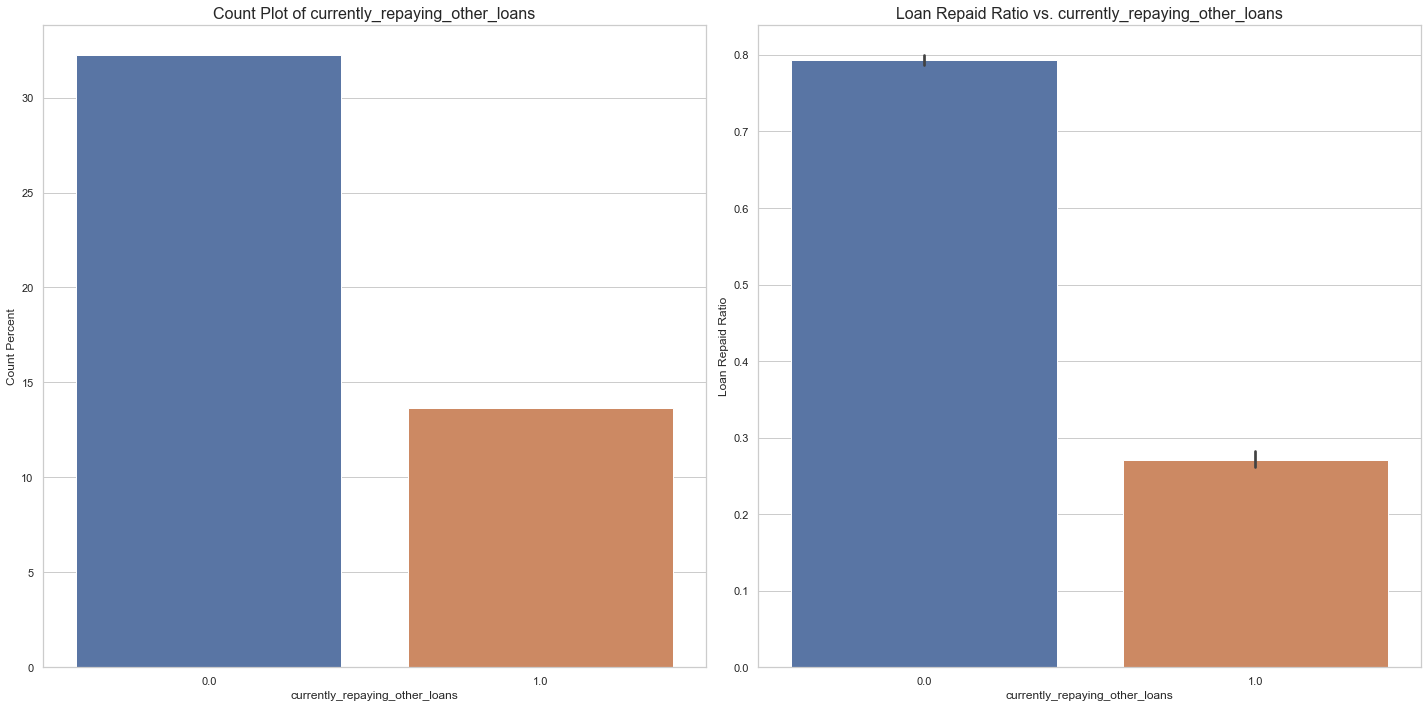

Loan Repayment Rate by other loans

Results:

- Around 14% loans were granted to borrowers who are currently paying other loans.

- Repayment Rate is less than 30% for those who are paying other loans.

#currently_repaying_other_loans

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

sns.barplot(x='currently_repaying_other_loans', y ='currently_repaying_other_loans',estimator=lambda x: len(x) / len(data) * 100, data=data, ax=ax[0])

ax[0].set_xlabel('currently_repaying_other_loans', fontsize=12)

ax[0].set_ylabel('Count Percent', fontsize=12)

ax[0].set_title('Count Plot of currently_repaying_other_loans', fontsize=16)

sns.barplot(x='currently_repaying_other_loans', y='loan_repaid', data=data, ax=ax[1])

ax[1].set_xlabel('currently_repaying_other_loans', fontsize=12)

ax[1].set_ylabel('Loan Repaid Ratio', fontsize=12)

ax[1].set_title('Loan Repaid Ratio vs. currently_repaying_other_loans', fontsize=16)

plt.tight_layout()

plt.show()

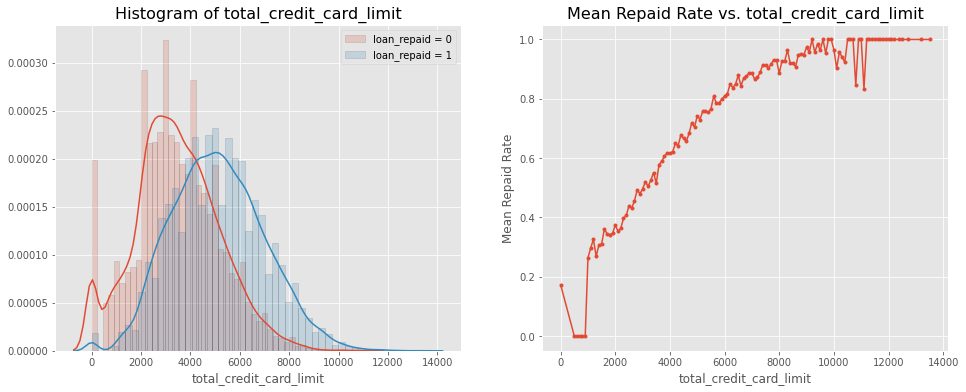

Loan Repayment Rate by Credit Card Limit

Results:

-

Borrowers who didn’t repay loan have credit card limit between $2000 to $6000, whereas the borrowers who did repay their loans had higher credit card limit ranging from $2000 to $10,000. These borrowers must be the ones with good credit scores.

-

Repayment rate increases as credit card limit increases. People approved for high credit limit must be the ones with good credit history so lesser chance of delinquency.

# Visualization of 'total_credit_card_limit'

grouped = data[['total_credit_card_limit', 'loan_repaid']].groupby('total_credit_card_limit')

grouped

mean = grouped.mean().reset_index()

mean

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.distplot(data[data['loan_repaid'] == 0]['total_credit_card_limit'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['total_credit_card_limit'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Histogram of total_credit_card_limit', fontsize=16)

ax[0].legend()

ax[1].plot(mean['total_credit_card_limit'], mean['loan_repaid'], '.-')

ax[1].set_title('Mean Repaid Rate vs. total_credit_card_limit', fontsize=16)

ax[1].set_xlabel('total_credit_card_limit')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

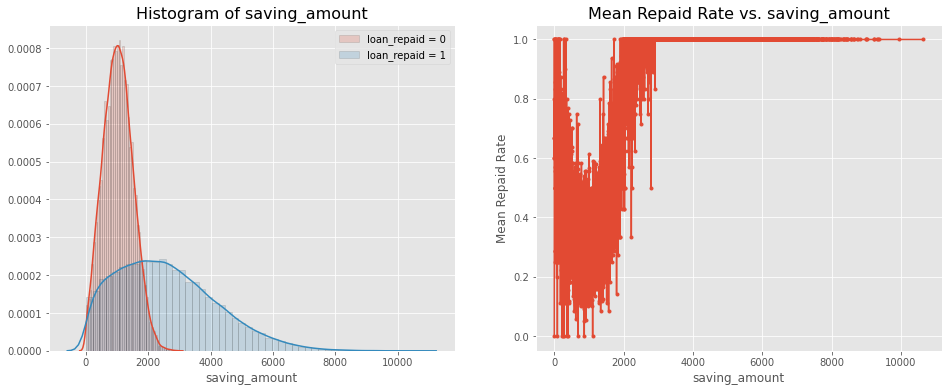

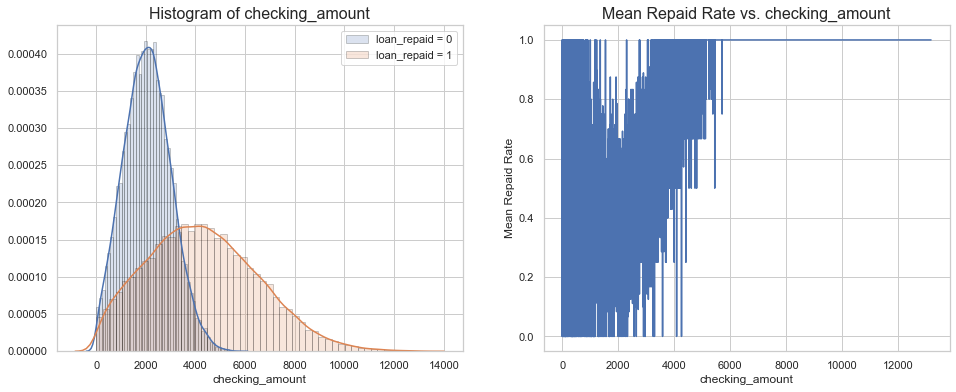

Loan Repayment Rate by Saving and Checking Amount

- Checking and Savings amount are important factors when deciding a borrower’s capacity to repay a loan.

- Borrowers who have lesser than ‘2000’ in savings and 4000 in checking are the ones who are more likely to default.

- Borrowers who have higher than 2000 in savings and anywhere from 2000 to 10,000 dollars in checking are the ones who have high repayment rate.

# Visualization of 'saving_amount'

grouped = data[['saving_amount', 'loan_repaid']].groupby('saving_amount')

grouped

mean = grouped.mean().reset_index()

mean

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.distplot(data[data['loan_repaid'] == 0]['saving_amount'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['saving_amount'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Histogram of saving_amount', fontsize=16)

ax[0].legend()

ax[1].plot(mean['saving_amount'], mean['loan_repaid'], '.-')

ax[1].set_title('Mean Repaid Rate vs. saving_amount', fontsize=16)

ax[1].set_xlabel('saving_amount')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

# Visualization of 'checking_amount'

grouped = data[['checking_amount', 'loan_repaid']].groupby('checking_amount')

grouped

mean = grouped.mean().reset_index()

mean

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.distplot(data[data['loan_repaid'] == 0]['checking_amount'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['checking_amount'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Histogram of checking_amount', fontsize=16)

ax[0].legend()

sns.lineplot(x= mean['checking_amount'], y= mean['loan_repaid'],ax = ax[1])

ax[1].set_title('Mean Repaid Rate vs. checking_amount', fontsize=16)

ax[1].set_xlabel('checking_amount')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

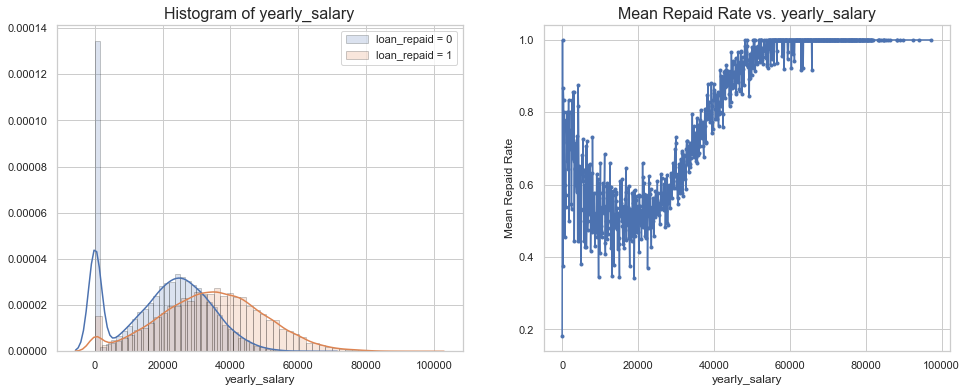

Loan Repayment Rate by Yearly Salary

Results:

- Borrowers who are unable to repay a loan earn less than 40,000 dollars a year

- Borrowers who earn more than 40,000 dollars a year have a repayment rate of more than 80%.

# Visualization of 'yearly_salry'

grouped = data[['yearly_salary', 'loan_repaid']].groupby('yearly_salary')

grouped

mean = grouped.mean().reset_index()

mean

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.distplot(data[data['loan_repaid'] == 0]['yearly_salary'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['yearly_salary'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Histogram of yearly_salary', fontsize=16)

ax[0].legend()

ax[1].plot(mean['yearly_salary'], mean['loan_repaid'], '.-')

ax[1].set_title('Mean Repaid Rate vs. yearly_salary', fontsize=16)

ax[1].set_xlabel('yearly_salary')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

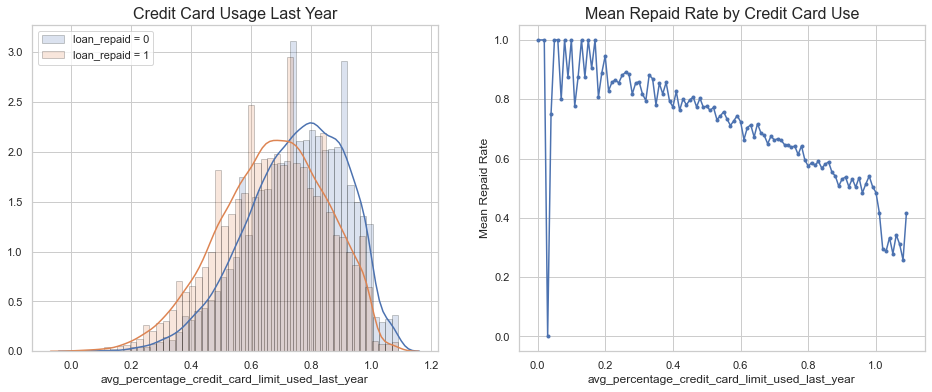

Loan Repayment by Last Year’s Credit Card Usage

Results:

- Borrowers unable to repay a loan have higher credit card usage than the ones who repay the loans.

- As the credit card usage increases, ability to repay a loan decreases.

not_null = data[~data['avg_percentage_credit_card_limit_used_last_year'].isnull()]

#avg_percentage_credit_card_limit_used_last_year

grouped = not_null[['avg_percentage_credit_card_limit_used_last_year', 'loan_repaid']].groupby('avg_percentage_credit_card_limit_used_last_year')

grouped

mean = grouped.mean().reset_index()

hist_kws={'histtype': 'bar', 'edgecolor':'black', 'alpha': 0.2}

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(16, 6))

sns.distplot(not_null[not_null['loan_repaid'] == 0]['avg_percentage_credit_card_limit_used_last_year'],

label='loan_repaid = 0', ax=ax[0], hist_kws=hist_kws)

sns.distplot(data[data['loan_repaid'] == 1]['avg_percentage_credit_card_limit_used_last_year'],

label='loan_repaid = 1', ax=ax[0], hist_kws=hist_kws)

ax[0].set_title('Credit Card Usage Last Year', fontsize=16)

ax[0].legend()

ax[1].plot(mean['avg_percentage_credit_card_limit_used_last_year'], mean['loan_repaid'], '.-')

ax[1].set_title('Mean Repaid Rate by Credit Card Use', fontsize=16)

ax[1].set_xlabel('avg_percentage_credit_card_limit_used_last_year')

ax[1].set_ylabel('Mean Repaid Rate')

ax[1].grid(True)

plt.show()

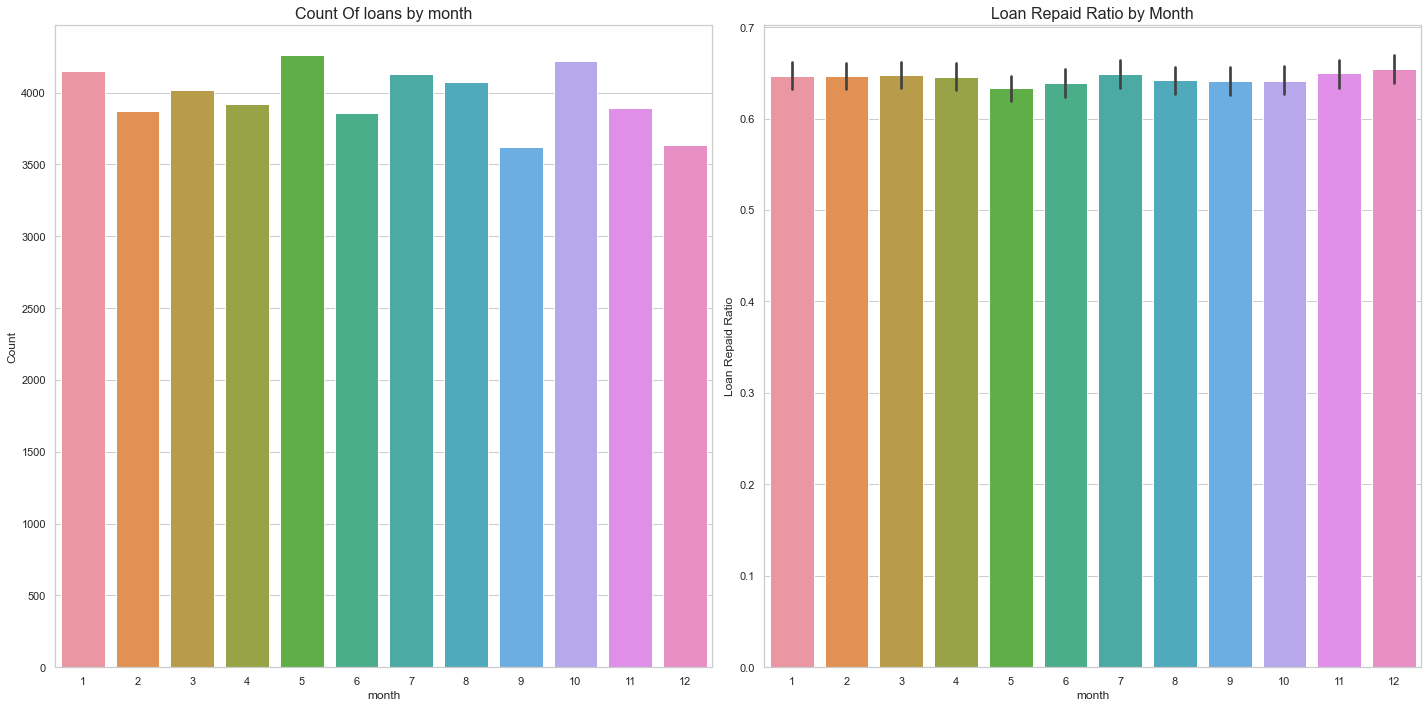

Repayment By Month

Results:

- A lot of loans are granted at the beginning of the year, in May and in October.

- Repayment rate remains almost the same across all the months.

fig, ax = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

sns.countplot(x='month', data=data, ax=ax[0])

ax[0].set_xlabel('month', fontsize=12)

ax[0].set_ylabel('Count', fontsize=12)

ax[0].set_title('Count Of loans by month', fontsize=16)

sns.barplot(x='month', y='loan_repaid', data=data, ax=ax[1])

ax[1].set_xlabel('month', fontsize=12)

ax[1].set_ylabel('Loan Repaid Ratio', fontsize=12)

ax[1].set_title('Loan Repaid Ratio by Month', fontsize=16)

plt.tight_layout()

plt.show()

We can even look at the relationship of various variables together such as loan purpose by is_employed and loan_repaid. A lot of the borrowers who are unemployed apply for emergency loans.

sns.set_style('ticks')

sns.set(font_scale = 2)

sns.catplot("is_employed", col='loan_purpose', data=data, hue='loan_repaid', kind="count", col_wrap=5)

<seaborn.axisgrid.FacetGrid at 0x12980c4f0>

Feature Engineering

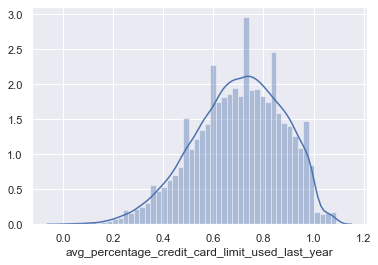

Avg_percentage_credit_card_limit

Avg_percentage_credit_card_limit_used_last_year is left-skewed which indicates that mean is lesser than the median so we will use median to impute the values

sns.set(font_scale = 1)

sns.distplot(data['avg_percentage_credit_card_limit_used_last_year'])

<matplotlib.axes._subplots.AxesSubplot at 0x12cddb6d0>

median_cc = data['avg_percentage_credit_card_limit_used_last_year'].median()

data = data.fillna({'avg_percentage_credit_card_limit_used_last_year':median_cc})

data.avg_percentage_credit_card_limit_used_last_year.isnull().sum()

0

#Rename avg_percentage_credit_card_limit_used_last_year to credit use

data.rename(columns={'avg_percentage_credit_card_limit_used_last_year':'credit_limit_used'},inplace=True)

is_first_loan, currently_repaying_loans, fully_repaid_previous_loans

We will create a new variable based on three columns: is_first_loan, currently_repaying_loans and fully_repaid_previous_loans :

Class 1: Not Repaid previous loan and currently paying other loans

Class 2: Paid previous loans and currently paying other loans

Class 3: First Loan

Class 4: Not paid previous loan and not paying other loans

Class 5: Repaid previous loan and not paying other loans

def new_variable(df):

if((df['is_first_loan'] == 0) & (df['fully_repaid_previous_loans'] == 0) & (df['currently_repaying_other_loans'] == 1)):

val = 1

elif((df['is_first_loan'] == 0) & (df['fully_repaid_previous_loans'] == 1) & (df['currently_repaying_other_loans'] == 1)):

val = 2

elif((df['is_first_loan'] == 0) & (df['fully_repaid_previous_loans'] == 1) & (df['currently_repaying_other_loans'] == 0)):

val = 5

elif((df['is_first_loan'] == 0) & (df['fully_repaid_previous_loans'] == 0) & (df['currently_repaying_other_loans'] == 0)):

val = 4

else:

val = 3

return(pd.Series(val))

res = data.apply(new_variable,axis = 1)

data['prev_loan_status'] = res

data.loc[data.is_first_loan == 0,['is_first_loan','fully_repaid_previous_loans','currently_repaying_other_loans','prev_loan_status']]

| is_first_loan | fully_repaid_previous_loans | currently_repaying_other_loans | prev_loan_status | |

|---|---|---|---|---|

| 8 | 0 | 1.0 | 0.0 | 5 |

| 9 | 0 | 1.0 | 0.0 | 5 |

| 13 | 0 | 1.0 | 0.0 | 5 |

| 17 | 0 | 1.0 | 0.0 | 5 |

| 40 | 0 | 1.0 | 0.0 | 5 |

| ... | ... | ... | ... | ... |

| 101081 | 0 | 1.0 | 0.0 | 5 |

| 101083 | 0 | 1.0 | 1.0 | 2 |

| 101088 | 0 | 0.0 | 0.0 | 4 |

| 101090 | 0 | 1.0 | 0.0 | 5 |

| 101098 | 0 | 1.0 | 0.0 | 5 |

21865 rows × 4 columns

group_loan = data[['prev_loan_status','loan_repaid']].groupby('prev_loan_status').agg({'count','mean'}).reset_index()

group_loan.columns = group_loan.columns.droplevel(0)

group_loan.columns = ['prev_loan_status','total_count','repaid_rate']

group_loan['cnt_pct'] = 100* group_loan['total_count']/group_loan['total_count'].sum()

group_loan

| prev_loan_status | total_count | repaid_rate | cnt_pct | |

|---|---|---|---|---|

| 0 | 1 | 682 | 0.218475 | 1.431150 |

| 1 | 2 | 5828 | 0.277454 | 12.229823 |

| 2 | 3 | 25789 | 0.650006 | 54.117178 |

| 3 | 4 | 1450 | 0.751724 | 3.042767 |

| 4 | 5 | 13905 | 0.797339 | 29.179083 |

Class 5(previous loan fully paid and not paying other loans) has the highest repayment rate of 79%.

54% of the loans granted are First time loans and have repayment rate of 65%.

yearly salary and employment correlated

Unemployed borrowers will not have a salary to report so we will remove one of them

print(data[data['is_employed'] == 0]['yearly_salary'].unique())

[0]

One hot encoding for loan purpose

K unique values, only need K-1 features, so remove one redundant feature

data_cp = pd.get_dummies(data)

Remove redundant columns

X_new = data_cp.drop(columns = ['loan_id','date','loan_granted','is_first_loan','fully_repaid_previous_loans','currently_repaying_other_loans','is_employed','loan_purpose_other'],axis = 1)

X_new.head()

| total_credit_card_limit | credit_limit_used | saving_amount | checking_amount | yearly_salary | age | dependent_number | loan_repaid | month | week | dayofweek | prev_loan_status | loan_purpose_business | loan_purpose_emergency_funds | loan_purpose_home | loan_purpose_investment | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2 | 6900 | 0.82 | 2085 | 3422 | 24500 | 38 | 8 | 1.0 | 7 | 29 | 0 | 3 | 0 | 0 | 0 | 0 |

| 5 | 6100 | 0.53 | 6163 | 5298 | 29500 | 24 | 1 | 1.0 | 11 | 45 | 2 | 3 | 0 | 0 | 0 | 0 |

| 7 | 4000 | 0.57 | 602 | 2757 | 31700 | 36 | 8 | 0.0 | 9 | 38 | 2 | 3 | 1 | 0 | 0 | 0 |

| 8 | 7000 | 0.52 | 2575 | 2917 | 58900 | 33 | 3 | 1.0 | 12 | 49 | 1 | 5 | 0 | 1 | 0 | 0 |

| 9 | 4300 | 0.83 | 722 | 892 | 5400 | 32 | 7 | 1.0 | 1 | 3 | 4 | 5 | 1 | 0 | 0 | 0 |

We have 16 features for model building

X_new.shape

(47654, 16)

LightGBM Model

LightGBM is a distributed and efficient gradient boosting framework that uses tree-based learning. It’s histogram-based and places continuous values into discrete bins, which leads to faster training and more efficient memory usage. In this piece, we’ll explore LightGBM in depth.

LightGBM Advantages

- Faster training speed and higher efficiency

- Lower memory usage

- Better accuracy

- Support of parallel and GPU learning

- Capable of handling large-scale data

- Is not affected by outliers and correlated variables

- Can handle categorical data

Train-Test Split

#Train test split

Y = X_new['loan_repaid']

Y.head()

2 1.0

5 1.0

7 0.0

8 1.0

9 1.0

Name: loan_repaid, dtype: float64

X = X_new.drop(columns= ['loan_repaid'],axis = 1)

X.shape

(47654, 15)

X_train, X_test, y_train, y_test = train_test_split(X, Y, test_size=0.25,random_state=42)

len(X_train),len(X_test),len(y_train),len(y_test)

(35740, 11914, 35740, 11914)

print(y_train.mean(),y_test.mean())

0.6450475657526581 0.6422695987913379

Prepare GBM Dataset and Tune Parameters

#create LightGBM dataset

d_train = lgb.Dataset(data=X_train, label=y_train,free_raw_data=False)

d_test = lgb.Dataset(data=X_test,label=y_test)

# Cross validation

#Using Default Values

params = {'learning_rate': 0.01,

'boosting_type': 'gbdt',

'objective': 'binary',

'metric': ['binary_logloss', 'auc'],

'sub_feature':0.8,

'num_leaves': 31,

'min_data': 20,

'max_depth': 15,

'is_unbalance': True}

history = lgb.cv(params, train_set=d_train, num_boost_round=1000, nfold=5,

early_stopping_rounds=10, seed=42, verbose_eval=False)

print('Best rounds:\t', len(history['binary_logloss-mean']))

Best rounds: 647

Prediction and Evaluation

# re-train the model and make predictions

clf = lgb.train(params, train_set=d_train, num_boost_round=647)

pred = clf.predict(X_test)

roc_auc = roc_auc_score(y_test,pred)

pred_int = (pred >=0.5).astype(int)

accuracy = accuracy_score(pred_int,y_test)

print('ROC score:{}, Accuracy at 0.5 threshold: {}'.format(roc_auc,accuracy))

ROC score:0.9774140994352406, Accuracy at 0.5 threshold: 0.9204297465167031

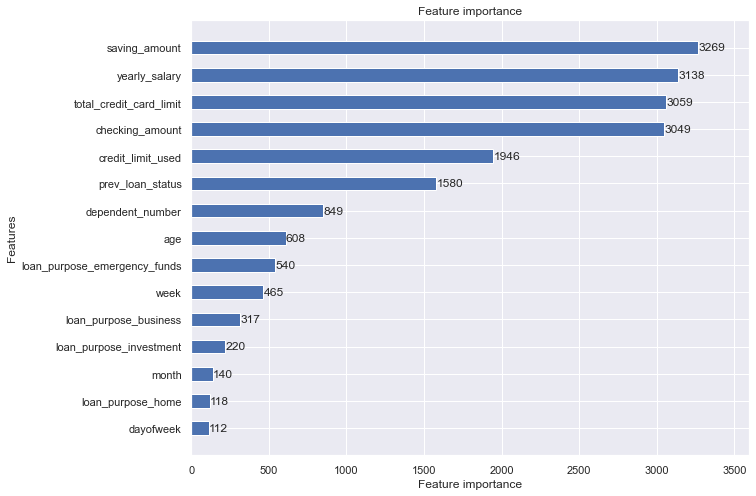

Feature Importance

Savings Amount, Yearly Salary, Total Credit Card Usage are among the top features that can help determine a borrower’s ability to repay a loan.

# feature importance

features = clf.feature_name()

importance = clf.feature_importance()

fig, ax = plt.subplots(figsize=(10, 8))

lgb.plot_importance(clf, ax=ax, height=0.5)

plt.show()

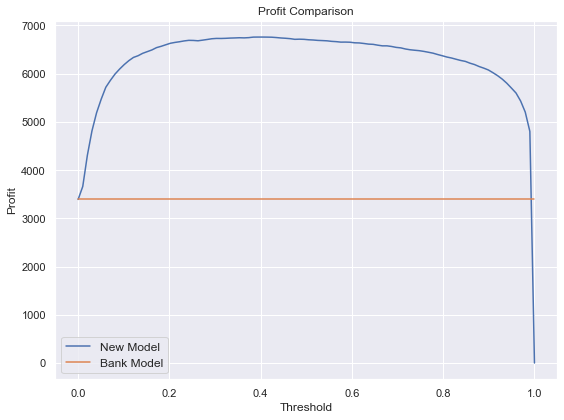

Bank Profit Calculation

We will assume if the loan is repaid then bank earns a $1 and if the loan is not repaid then a loss of -1.

Bank profit by old model

#Total Profit from original Bank model

loan_paid = y_test.astype(int).values

bank_profit = np.sum(loan_paid * 2 - 1)

print('Bank profit:\t', bank_profit)

Bank profit: 3390

Bank profit by New Model at different thresholds

We will calculate the profit at different thresholds and choose the one where we get maximum profit

# Calculate profit according to different thresholds

def calc_threshold(loan_paid,probability,threshold):

loan_granted = (probability > threshold).astype(int)

profit = 0

for i in range(len(loan_paid)):

if loan_granted[i] == 1:

if loan_paid[i] == 0:

profit -= 1

else:

profit += 1

return profit

# calculate the profit according to given threshold

thresholds = list(np.linspace(0, 1, 100))

profits = []

for threshold in thresholds:

profits.append(calc_threshold(loan_paid, pred, threshold))

thresh_prof = pd.DataFrame({'threshold':thresholds,'profit':profits})

thresh_prof.loc[thresh_prof.profit.argmax(),:]

threshold 0.393939

profit 6756.000000

Name: 39, dtype: float64

With the new model, bank can make a profit of 6756 dollars which is double of the bank’s earlier profit of 3390.

fig, ax = plt.subplots(figsize=(8, 6))

ax.plot(thresholds, profits, label='New Model')

ax.plot(thresholds, [bank_profit] * len(thresholds), label='Bank Model')

ax.set_xlabel('Threshold', fontsize=12)

ax.set_ylabel('Profit', fontsize=12)

ax.set_title('Profit Comparison')

ax.legend(fontsize=12)

plt.tight_layout()

plt.show()

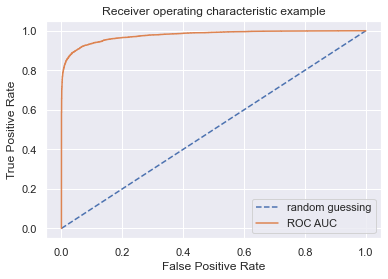

fpr,tpr,threshold = roc_curve(loan_paid, pred)

print("Area under the Receiver Operating Characteristic Curves (ROC AUC) is %f "

%(roc_auc_score(loan_paid, pred)))

Area under the Receiver Operating Characteristic Curves (ROC AUC) is 0.977414

plt.figure()

plt.plot([0,1],[0,1], linestyle = '--', label = 'random guessing')

plt.plot(fpr, tpr, label = "ROC AUC" )

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.title('Receiver operating characteristic example')

plt.legend(loc='lower right')

<matplotlib.legend.Legend at 0x137690a30>

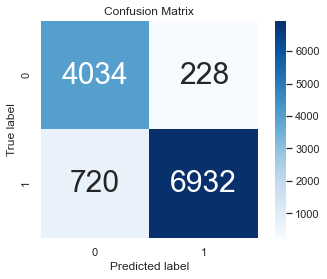

Classification Report at 0.5 threshold

False Positives: If the model predicts that a loan will be repaid and the borrower defaults, then bank will lose money. We would like to keep our false positives low.

False Negatives: If the model predicts that a loan will not be repaid but the borrower does repay, the bank might lose a potential customer by not granting a loan. In this case loss is going to be 0.

More than False negatives, we should focus on high precision and keeping the false positives low.

print(classification_report(y_true = y_test, y_pred=pred_int))

precision recall f1-score support

0.0 0.85 0.95 0.89 4262

1.0 0.97 0.91 0.94 7652

accuracy 0.92 11914

macro avg 0.91 0.93 0.92 11914

weighted avg 0.93 0.92 0.92 11914

cm = confusion_matrix(y_test, pred_int)

# view with a heatmap

sns.heatmap(cm, annot=True, annot_kws={"size":30}, cmap='Blues', square=True, fmt='.0f')

plt.ylabel('True label')

plt.xlabel('Predicted label')

plt.title('Confusion Matrix')

Text(0.5, 1.0, 'Confusion Matrix')

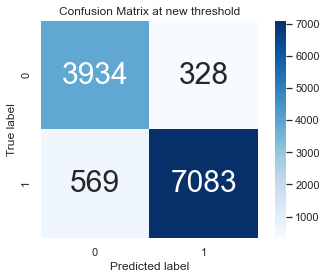

Precision and Recall at 0.4 threshold

We can see that the true positive predictive power i.e model predicts that a borrower will reapy and borrower did repay increased at the new threshold.

pred_int_new = (pred >= 0.39).astype(int)

accuracy_score(y_test,pred_int_new)

0.9247104247104247

print(classification_report(y_true = y_test, y_pred=pred_int_new))

precision recall f1-score support

0.0 0.87 0.92 0.90 4262

1.0 0.96 0.93 0.94 7652

accuracy 0.92 11914

macro avg 0.91 0.92 0.92 11914

weighted avg 0.93 0.92 0.93 11914

cm = confusion_matrix(y_test, pred_int_new)

# view with a heatmap

sns.heatmap(cm, annot=True, annot_kws={"size":30}, cmap='Blues', square=True, fmt='.0f')

plt.ylabel('True label')

plt.xlabel('Predicted label')

plt.title('Confusion Matrix at new threshold')

Text(0.5, 1.0, 'Confusion Matrix at new threshold')

Strategy for Denied Application

My model is able to predict 7083 loans will be repaid and they did. The true positive predictive accuracy is 91.1 %. Thus, if we grant a loan to a previously denied application then the bank can make a lot of profit.

pos_ind = (pred_int_new == 1)

tpr_new = np.sum(y_test[pos_ind] == 1) # number of loan repaid

print("number of cases that model predicts repay and repaid: {}".format(tpr_new))

fpr_new = np.sum(y_test[pos_ind] == 0) # number of loan defaulted

print("number of cases that model predicts repay but defaulted: {}".format(fpr_new))

tot = (np.sum(y_test[pos_ind] == 1) - np.sum(y_test[pos_ind] == 0))/sum(pos_ind)

print("score to gain when granting a loan: {}".format(tot))

number of cases that model predicts repay and repaid: 7083

number of cases that model predicts repay but defaulted: 328

score to gain when granting a loan: 0.9114829307785723

Impact Analysis of “is_employed”

Results:

- There are 1047 unemployed borrowers and 10,867 employed borrowers in the dataset

- If an applicant is unemployed, then our model predicts 14% of the loans will be repaid and grants them the loan. If an applicant is employed, then model predicts 67% of the loans will be repaid and grants them the loan.

- Among the ones who are unemployed and model predicts to grant the loan, 94.4% repay the loans.

- Among the ones who are employed and model predicts to grant the loan, 95.5% do repay the loans.

unemployed = len(X_test[X_test['yearly_salary'] == 0])

not_emp = len(X_test) - unemployed

print('Number of unemployed borrowers in the test set : {}\nNumber of employed borrowers : {}'.format(unemployed,not_emp))

Number of unemployed borrowers in the test set : 1047

Number of employed borrowers : 10867

loan_grant_unemp = pred_int_new[X_test['yearly_salary'] == 0].mean()

loan_grant_emp = pred_int_new[X_test['yearly_salary'] != 0].mean()

print('Loan Grant Rate for unemployed by the model : {}\nLoan Grant Rate for employed by the model:{}'.format(loan_grant_unemp,loan_grant_emp))

Loan Grant Rate for unemployed by the model : 0.13753581661891118

Loan Grant Rate for employed by the model:0.6687218183491304

#Repay rate for unemployed

unemployed_granted_ind = np.logical_and(X_test['yearly_salary']==0,pred_int_new==1)

unemp_repay = y_test[unemployed_granted_ind].mean()

0.9444444444444444

#Repay rate for employed

employed_granted_ind = np.logical_and(X_test['yearly_salary']!=0,pred_int_new==1)

emp_repay = y_test[employed_granted_ind].mean()

emp_repay

0.9559653226916196

Savings Amount

pred_int_new[X_test['saving_amount'] < 4000].mean()

0.5704473910140228

pred_int_new[X_test['saving_amount'] >= 4000].mean()

1.0

Recommendations:

-

According to the feature importance plot, the most important feature is ‘savings amount’. This makes perfect sense because if a person has money in the savings account, it is more likely that he/she will be able to repay the loan. Given the data, our model predicts 100% repayment if savings amount exceeds 4000 dollars

-

Borrower’s employment status is very important. If a person is employed it is highly likely that he/she will be able to repay the loan. Target customers who are employed and have a yearly salary of atleast 60,000. This will reduce the probability of default.

-

Number of dependents does affect the repayment rate to some extent. Bank should modify it’s strategy to reduce giving loans to people with 8 dependents and give more loans to people with less dependents

-

Borrowers who have high credit card limit could mean they have good financial standing to be approved for such limits. These users have higher chance of repaying the loans. Hence, they could be granted a loan.

-

The gradient boosted model developed should be implemented and loans should be given to the ones predicted to have high repayment probability. This model has 92% positive predictive power and provides double the profit the bank is currently making.